- Homepage

- Admissions

- Apply to UF Law

- LL.M. and S.J.D. Admissions

LL.M. and S.J.D. Admissions

Welcome! We’re glad that you are interested in the University of Florida Fredric G. Levin College of Law LL.M. programs. Our tax program has trained more than 4,000 tax attorneys practicing around the globe. When you graduate, you will join a network of over 22,000 Florida Law alums working across the nation and in 60 countries.

We invite you to learn more about our programs and offerings by exploring our website. Feel free to contact us at Grad-Tax@law.ufl.edu, (352) 273-0890 or toll-free at (877) 429-1297 to learn more about our campus and your opportunities at Florida Law.

Application Options and Timelines

The University of Florida offers three graduate tax degrees and flexible methods of instruction which meet the needs of a variety of students.

Application Instructions

All applicants to Florida Law’s graduate programs must first create a free account and register with the Law School Admission Council’s (LSAC) Credential Assembly Service. After you register, you must submit all required documents to LSAC.org. Please note that this process is mandatory. You will find that it streamlines and speeds the application process, while eliminating multiple transcript requests and associated costs. In addition, LSAC.org provides transcript summarization for applicants who are educated outside the United States. International applicants should review our additional requirements and recommendations before applying. Learn more here.

Please note that LSAC does not currently permit LL.M./S.J.D. applicants with existing J.D. accounts to use those accounts to apply to graduate programs. You must create a new account using the LL.M. link above.

Follow the links below to review additional details about these programs.

- LL.M. in Taxation

- LL.M. in International Taxation

- LL.M. in U.S. Law

- Three-Semester LL.M. in International Taxation or Taxation with a Concentration in U.S. Law

S.J.D. in Taxation – Florida Law will accept applications for fall 2025 from February 1, 2025, through February 28, 2025 through the LL.M. application at LSAC – Email Graduate Tax Program (grad-tax@law.ufl.edu) for additional information.

Current UF J.D. students interested in the 7-semester program:

UF Law 2Ls are eligible to apply to the 7-semester JD/Tax LL.M. program starting in the spring semester of the 2L year and continuing until mid-summer following the 2L year. To be eligible to apply, students must have a cumulative JD GPA of at least 3.0 and have received a final grade of B+ or better in either (A) two JD tax classes or in (B) one JD tax class and one JD class in business, commercial, financial, real estate, trusts & estates, or administrative law. Eligibility to apply does not guarantee admission; decisions regarding admission are made by the same committee that determines main program LL.M. admissions. If you are interested in this opportunity, contact the Graduate Tax Program (grad-tax@law.ufl.edu) for more detailed instructions before applying through LSAC for the 7-semester program.

International Students

After you are admitted, Florida Law will request a Form I-20 for you. The International Center at UF will then contact you and provide the information and guidance required for obtaining the necessary visa. For additional information about studying in the United States and the Form I-20, please see https://studyinthestates.dhs.gov/students.

KEY DATES

Spring 2025 (January start) – Three-semester International Tax LL.M. with U.S. Law Concentration or Part-Time Tax (or International Tax) LL.M.:

- Application opens August 06, 2024

- Application closes November 15, 2024 for applicants not requiring an I-20 for visa purposes

- For applicants requiring an I-20 to obtain or transfer a visa for UF attendance: UF Law must receive all required documents no later than September 13, 2024, to meet university I-20 request deadlines.

Fall 2025 LL.M. (August start):

- Application opens September 1, 2024

- Application closes July 15, 2025

- For applicants requiring an I-20 to obtain or transfer a visa for UF attendance: UF Law must receive all required documents no later than April 1, 2025, to meet university I-20 request deadlines.

7-semester (current Florida Law J.D. students only):

- Application opens January 15, 2025

- Application closes July 15, 2025

Fall 2025 S.J.D. (August start):

- Application opens February 1, 2025

- Application closes February 28, 2025

Program Choices

| Program | Semester start | Time | Credit load | Length to complete* | Mode of Instruction | Ideal for: | Cost |

| Tax & International Tax (Full-time) | Fall | Full-time | 10-17 credits/ semester 26 Total | 2 semesters | In-person or synchronous online | JD grads who want to add an LL.M. degree in the shortest amount of time; working attorneys anywhere in the world | Block tuition (charged per semester): $10,605.53 (resident per semester); $18,996.90 (nonresident, per semester) |

| Tax & International Tax (Part-time) | Fall or Spring | Part-time | 2-9 credits/ semester 26 Total | 4-10 semesters | In-person or synchronous online | Working attorneys in the Gainesville area or within driving distance; working attorneys anywhere in the world | $815.81/credit hour resident; $1,461.30/credit hour non-resident |

| Dual J.D./LL.M. | Fall | Full-time | 10-17 credits 101 Total (75 JD and 26 LLM) | 7 total semesters (5 JD and 2 LLM) | In-person | Current UF Levin College of Law students and transfer students admitted to the 7-semester program | JD tuition for 3 years; LLM tuition for final semester: $10,605.53/ resident; $18,996.90/ nonresident |

| International Tax LL.M. with U.S. Law Concentration | Fall or Spring | Full-time | 10-17 credits/ semester 38 Total (26 LLM and 12 for concentration in US Law) | 3-4 semesters | In-person | International attorneys who want to meet course requirements to sit for the New York or other state bar exam | Block tuition (charged per semester): $10,605.53 (resident per semester); $18,996.90 (nonresident, per semester) |

| S.J.D. | Fall | Full-time | 2-17 credits/ semester 30 Total | 2 semesters in full-time residence + 6 credits of dissertation | In-person at least 2 semesters | $815.81/credit hour resident; $1,461.30/credit hour non-resident | |

| LL.M. in U.S. Law | Fall | Full-time | 10-17 credits/ semester 26 Total | 2 semesters | In-person | For graduates of non-U.S. law schools | Block tuition (charged per semester): $9,663.03 (resident, per semester); $16,858.40 (non-resident, per semester) |

Learn More about the 7-semester program

COSTS AND FINANCIAL AID

Tuition & Expenses

For full-time Graduate Tax students, resident tuition is $10,606 per semester and nonresident tuition is $18,997 per semester. Full-time students generally complete the degree in 2 semesters.

Students who take 9 or fewer credits in a semester pay tuition per credit. The per-credit rate for part-time students is $816 per credit for Florida residents and $1,461.30 per credit for non-residents.

There is also a $200 Pathways to Tax Practice program fee for both full-time and part-time students.

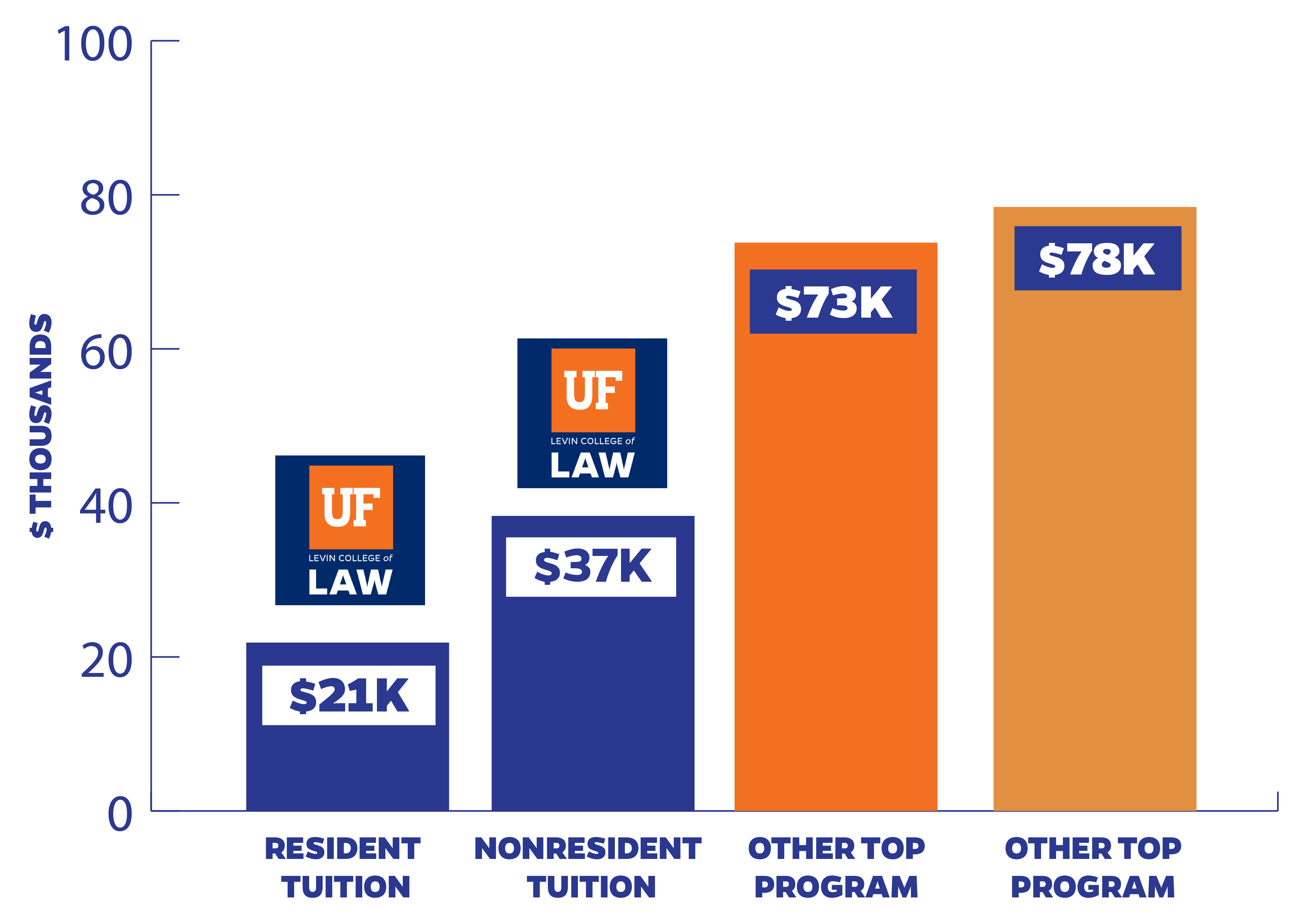

Florida Law tuition relevant to other Top Programs

Scholarships

The Graduate Tax Program offers a limited number of scholarships to incoming LL.M. students. All scholarships are awarded after admission and applicants are notified via email. Early application to the Tax and International Tax LL.M. Programs is encouraged as these opportunities are offered on a rolling basis. Applicants are strongly encouraged to include class rank under the Education section of the application for scholarship consideration. Part-time students and S.J.D. students are generally not eligible for scholarships and we do not offer Graduate Assistantships.

Non-resident Scholarships

Awarded to non-Florida residents to reduce or eliminate the difference between resident and non-resident tuition.

Florida Tax Review Student Editor Scholarships

Students with strong academic records in tax and prior journal experience or other related experience will be considered. If you have questions about this opportunity, contact Graduate Tax Program (grad-tax@law.ufl.edu).

Other Financial Aid

Academic Common Market Waiver

The Academic Common Market consists of a group of states that allow a resident of a member state to obtain in-state tuition in a different member state for programs not available in the student’s resident state. Currently,* the list of states that recognize the Florida Law tax LLM program consists of Alabama, Arkansas, Kentucky, Louisiana, Mississippi, Oklahoma, Tennessee, South Carolina, and West Virginia.

*Periodically, a state may determine that our program is no longer qualifying. Each state sets its own criteria for residency as well as for eligibility of the program. This often includes a requirement that the student attend the program full time and/or in person. Students must go through the ACM office for their resident state to obtain this benefit.

If you believe your residency status qualifies you for an ACM Waiver, please contact admissions, Grad-Tax@law.ufl.edu after submitting your application.

Research Assistant Positions

Research Assistant positions are available. Research Assistants are paid an hourly wage for up to ten (10) hours of work per week. Interested students should contact the Graduate Tax Program (grad-tax@law.ufl.edu).

FULBRIGHT FELLOWSHIP PROGRAM

The Fulbright Fellowship Program, involves the participation of a large set of collaborating partners in supporting Fulbright fellows at the University of Florida. For general questions about the Fulbright fellowship program and the logistics of admitting a Fulbright fellow, please contact Matt Mitterko, Associate Director, Graduate International Outreach (352) 392-0098; mmitterko@aa.ufl.edu.

LINKAGE INSTITUTE PROGRAMS

The State of Florida has established Linkage Institute programs for several countries and regions. A limited number of well-qualified students who are citizens of “linkage” countries are permitted to pay resident rather than non-resident tuition for a specified number of credit hours. Linkage programs currently exist for the following countries and regions: Brazil, Canada, the Caribbean, China, Costa Rica, Eastern Europe, France, Israel, Japan, Mexico and West Africa.

EDUCATIONUSA

EducationUSA and the Department of State may cover the up-front costs of applying to Florida Law (application costs, translations, exams, etc.). The program is called the EducationUSA Opportunity Fund. For more details, please go to https://educationusa.state.gov/foreign-institutions-and-governments/special-programs. The program is for talented students who come from low-income families and who do not have the financial resources to cover costs related to the application process.

LOANS

A variety of loans, including Guaranteed Student Loans, may be available. Early application is encouraged to allow adequate processing time before the start of a term. For loan information and applications, please contact the financial aid coordinator at sfa-law@mail.ufl.edu.

REQUIRED DOCUMENTS

APPLICATION

The Florida Law LL.M. Flex App can be found on LSAC.org. Please see the Timeline above for opening and closing dates. The law school code for the University of Florida Levin College of Law is 5812. Applicants are encouraged to answer all questions, including

Law Degree:

All applicants must possess a U.S. juris doctor or international first professional degree in law (must be law major) conferred prior to the first day of law classes of the application term.

LL.M. CAS Report:

After you submit your application to Florida Law via LSAC’s Flex App, LSAC will automatically send us a copy of your CAS report.

Your LL.M. CAS Law School Report includes:

- copies of all undergraduate, graduate, and law/professional school transcripts;

- an International Credential Evaluation report (for international applicants only);

- copies of letters of recommendation; and

- copies of English proficiency exam scores (TOEFL and/or IELTS), if applicable. The Levin College of Law requires the TOEFL or IELTS for LL.M. applicants whose primary mode of educational instruction has not been in English. To be competitive for admission, foreign-educated, non-English speaking applicants generally possess at least a 100 TOEFL or 7.0 IELTS score. If you have questions, please contact grad-tax@law.ufl.edu.

When you register for the CAS, you will be provided with an LSAC account number (L number). Use this number to identify yourself on all subsequent LSAC interactions.

Letters of recommendation:

At least two (2) letters of recommendation are required. Letters should address your academic, professional and/or personal background and aptitude for graduate-level legal study. To the extent practical, letters of recommendation should be submitted via LSAC.

Attachments:

Please upload the required personal statement and resume/CV, as well as any character & fitness explanations and using the Flex App’s upload feature. S.J.D. applicants are also required to upload a research proposal for their dissertation project. Any additional documents should be attached using the “optional addendum” link(s).

Evaluative Interviews:

The Admissions Committee may, at their discretion, invite candidates to interview in order to learn more about the candidate prior to rendering an admission or scholarship decision. Interviews are by invitation only and candidates may not request an interview.

Appealing an Admissions Decision:

To appeal the decision to deny admission to the College of Law, an applicant must send a written appeal to Grad-Tax@law.ufl.edu within ten (10) business days of receipt of the admissions decision. The applicant’s full name and “Appeal of Admission Decision” must be in the subject line of the email. The appeal must provide new and compelling material information that was not available to the applicant at the time of the initial admissions decision. New grades, additional activities and honors, and appeals by someone other than the applicant are never considered.

The final decision will be communicated to the applicant by reply email within ten (10) business days of receipt of the appeal.

The decision on petition for reconsideration is final and is not subject to further appeal.

Graduation Requirements

LL.M. Degrees

The LL.M. in Taxation degree is awarded upon satisfactory completion of 26 semester credit hours with a cumulative grade point average of 3.0 or higher. At least 22 of these credits must be in graded LL.M. tax courses, and students are required to complete a 2-credit Tax Research Seminar course, which includes a research paper component.

The same requirements apply to students seeking the LL.M. in International Taxation, except that 13 of the required LL.M. credits must be in international tax courses.

S.J. D. in Taxation

A candidate for the S.J.D. in Taxation degree is expected to spend at least three semesters in residence and complete 30 credit hours of graduate tax coursework, including at least eight credits in writing seminars and supervised research and writing, with a cumulative grade point average of at least 3.5. In appropriate circumstances, courses other than graduate tax courses may be approved to meet degree requirements. The degree must be completed within five years and is awarded only on the successful completion of a thesis, which may consist of a single monograph or a series of at least three major articles, and must be defended before, and approved by, the candidate’s supervisory committee.